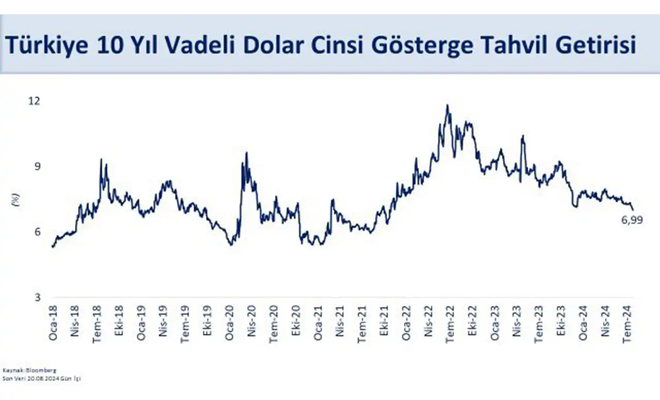

Türkiye's 10-year US dollar bond yield drops below 7% for first time since 2021

Türkiye's Treasury and Finance Minister Mehmet Şimşek announced that the yield on the country's 10-year US Dollar benchmark bond has fallen below 7 percent for the first time since November 2021.

Google News'te Doğruhaber'e abone olun.

Google News'te Doğruhaber'e abone olun. In a statement on X, Minister Şimşek highlighted the success of Türkiye's economic policies, stating: "The yield on our 10-year US Dollar benchmark bond fell below 7 percent for the first time since November 2021. With our decisive program, we strengthened macro financial stability and reduced the risk premium. Thus, our external borrowing costs declined significantly."

He emphasized the positive impact of this development on Türkiye's economy, noting that the decrease in borrowing costs would also benefit the private sector's access to external financing. He further indicated that the government is committed to maintaining and building on these gains.

"In the period ahead, we will further improve our risk premium by making our gains permanent with structural steps," Şimşek added, signaling continued efforts to bolster Türkiye's financial stability and reduce borrowing costs through long-term economic reforms. (ILKHA)